About Us

.jpg)

For more than 75 years, people across Kentucky have put their trust in Kentucky Farm Bureau Insurance. Today, our company protects more than 462,000 Kentucky families and businesses with our top-ranked insurance products.

We employ approximately 700 people across the state of Kentucky, and our State Office is located in Louisville. We’ve also got agency offices in all 120 counties of Kentucky.

At Kentucky Farm Bureau, there are endless ways to unlock your career potential. No matter your expertise, we’ve got a position that’s right for you.

Want to see KFB’s workplace culture in action? Click here to follow us on LinkedIn.

We have opportunities in eight different areas at the state office. Explore the drop-down menus below for more information.

Kentucky Farmland Transition Initiative

N Main St

Beth Owens-Wall

Bob Dixon

About Us

| OFFICERS | ||

| President | Jeremy Dotson | |

| Vice President | Mike Woods | |

| Secretary | Alfred Hurst Nuckols | |

| Treasurer | Beau Neal | |

| Farm Bureau Women's Chair | Melissa Tomblin | |

| Young Farmer Chair | Martha Prewitt | |

| DIRECTORS | ||

| Chris Allen | Versailles | |

| Paul Allen | Versailles | |

| Austin Baker | Versailles | |

| Kerry Barling | Frankfort | |

| Bill Barrows | Versailles | |

| Bob Mac Cleveland | Versailles | |

| Curtis Congleton | Versailles | |

| Jeremy Dotson | Versailles | |

| Byron Drury | Versailles | |

| Billy Gaines | Versailles | |

| Paul Gonnelli | Frankfort | |

| Jeff Greenwell | Frankfort | |

| Hunter Hicks | Versailles | |

| Jack Jones | Versailles | |

| Shawn Knight | Frankfort | |

| Jesse Lane | Versailles | |

| Edwin Lippert | Versailles | |

| David Martin | Midway | |

| Donald Mitchell | Midway | |

| Luke Mitchell | Versailles | |

| Beau Neal | Versailles | |

| Alfred Nuckols | Midway | |

| James Perry | Versailles | |

| Patty Perry | Versailles | |

| Lillian Portwood | Versailles | |

| Martha Prewitt | Versailles | |

| Adam Probst | Versailles | |

| Ken Reed | Versailles | |

| Bryan Richardson | Versailles | |

| Jeremy Shryock | Versailles | |

| Rusty Thompson | Versailles | |

| Travis Thompson | Versailles | |

| Melissa Tomblin | Versailles | |

| Darrell Varner | Midway | |

| Kristen Vestesen | Versailles | |

| Rick Wallin | Midway | |

| Michael Woods | Versailles |

About Us

OFFICERS

| President | Joyce Teague | |

| Vice President | B.G. Wingham | |

| Secretary/Treasurer | Jamae Pyles | |

| Farm Bureau Women's Chair | Vacant | |

| Young Farmer Chair | Cody Heveline |

DIRECTORS

| Wayne Alexander | Milton | |

| Glen Fisher | Bedford | |

| Tammy Ginn | Milton | |

| Cody Heveline | Milton | |

| Mark Mullins | Bedford | |

| Cecilia Oak | Bedford | |

| Jamae Pyles | Bedford | |

| Joyce Teague | Bedford | |

| B.G. Wingham | Milton | |

| Brent Wingham | Milton | |

Jamie Wright

Pat Hargadon

Pat is your local Shelby County Farm Bureau insurance agent!

Kentucky Farm Bureau has provided residents of the Bluegrass with quality insurance since 1943. As your local agent, I’m proud to serve the Shelby County community and take care of all your insurance needs with prompt service and personal attention. That’s what being Kentucky’s insurance company is all about. We offer home insurance, auto insurance, life insurance and more. Contact me today for a free quote!

Pat Hargadon has been an agent with Kentucky Farm Bureau in Shelby county since 1986. He has served an agency manager since 2000. Pat is an active member of the community and had earned numerous recognitions and awards for his service, most recently being named a 2019 WLKY Bell Award recipient. His current positions include:

- Director, Metro United Way

- Director, Shelby County Industrial Foundation

- Director, Citizens Union Bank

- Commissioner, US 60 Water District

- Director, Shelby County Community Foundation

- Director, Shelby Energy

Pat attended the University of Louisville and is a graduate of Leadership Kentucky and the Philip Morris Agriculture Leadership Development Program. Pat enjoys spending time with family and friends on the family farm where he grew up in Waddy, KY.

KFB President Eddie Melton: Sustaining the Future of Kentucky Farms

I’m very fortunate to have grown up on a family farm in Webster County. Our tradition, which began so many years ago, is alive and well today. With the farm being owned and operated by our family, it was a fairly easy process to take over when my time came.

We see many farms in Kentucky being passed down in much the same way from generation to generation.

That’s good in many cases, but it can still be complicated to transition farms even in the case of inheritance.

We also often hear of difficulties for those first-time farmers who don’t have access to land, and we continue to see valuable farmland being sold for non-agricultural use at prices that our farmers cannot make work.

With all that said, we’ve come to a crossroads where continued struggles in the transition process along with the ongoing loss of production farmland and family farms have to be addressed collaboratively to ensure the future of the farm.

By finding ways to transition current production farmland into the hands of new farmers, we can begin to slow the losses we have seen in the most recent agriculture census.

According to data contained in the last two ag censuses, which cover a total of 10 years, there has been a 10 percent drop in the number of Kentucky farms. In 2012, the census reported 77,064 farms in the Commonwealth. That number dwindled to 69,495 in 2022.

During that same period, there has been nearly a five percent decline in the number of farmed acres in Kentucky. While that doesn’t sound like a big percentage, when you look at the actual land area that is no longer being used for farming, it is a decrease of over 600,000 acres.

Perhaps the most telling of the census numbers, though, is total farm production costs have increased more than 28 percent over those same 10 years.

The good news is our farmers are the best producers in the world. We see increased yields of our crops regularly and have reached record farm cash receipts. And while the data before us can be daunting, one thing we can’t measure in numbers is the will of the human spirit.

Our farm families are so dedicated to their farming heritage. Enabling active and next generation farmers to carry on this historic tradition, which quite simply we all depend on, should be a priority for the entire agriculture industry, and frankly a priority for the protection of our food supply as a nation.

Kentucky Farm Bureau is announcing the creation of the Kentucky Farmland Transition Initiative (KFTI) which will help get us on a sustainable path to ensure our farmland remains in agricultural production.

There will be more information coming soon and continuously as we initiate this program.

We cannot accomplish the goal of getting more farmland in the hands of active farmers by ourselves. This work requires being willing to start these conversations and collaborate to achieve this goal. If we work together as a collective agriculture industry and bring decision-makers at all levels to the discussion table, we can make this and other efforts successful. Stay tuned!

2024 Boyd County Farm Bureau Annual Meeting / Dinner

2024 Boyd County Farm Bureau Annual Meeting / Dinner

Monday, October 21, 2024 at 6:30 p.m.

Boyd County Extension Franks Community Building

1758 Addington Road

Ashland, KY 41102

Calendar Of Events

About Us

OFFICERS

| President | David Chappell | |

| 1st Vice President | Pam Stockdale | |

| 2nd Vice President | Joy Collligan | |

| Secretary/Treasurer | Lisa McBurney | |

| Farm Bureau Women's Chair | Kristal New | |

| Young Farmer Chair | Kendall Bowman |

DIRECTORS

| Larry Ayers | Owenton | |

| Steven Bond | Sparta | |

| Jim Bush | Owenton | |

| Sandy Bush | Owenton | |

| James Cammack | Dry Ridge | |

| David Chappell | Owenton | |

| Sandra Chappell | Owenton | |

| Charles Colligan | Owenton | |

| Joy Colligan | Owenton | |

| John New | Owenton | |

| Kristal New | Owenton | |

| Charles Richardson | Owenton | |

| Dwight Stockdale | Owenton | |

| Pamela Stockdale | Owenton |

Young Farmer Contests

*Contest applicants are eligible to compete in only one contest per year*

Outstanding Young Farm Family

The Outstanding Young Farm Family recognizes Young Farmers who have excelled in their farm or ranch and have honed their leadership abilities to superiority. Participants are involved in production agriculture with a majority of their income subject to normal production risks. Judges evaluate competitor's excellence in management, growth and scope of their enterprise and self-initiative that have been displayed throughout the farm or ranch.

Applications are due May 14, 2024.

2024 Outstanding Young Farm Family Application

2024 Outstanding Young Farm Family Rubric

Excellence In Agriculture

The Young Farmers (YF) Excellence in Agriculture Award competition is designed as an opportunity for young farmers and ranchers to earn recognition, while actively contributing and growing through their involvement in Farm Bureau and agriculture. Participants will be judged on their involvement in agriculture, leadership ability, and participation/involvement in Farm Bureau and other organizations (i.e., civic, service and community). The ideal candidate(s) for the Excellence in Agriculture Award is an individual or couple who does not have the majority of his/her gross income subject to normal production risk.

Applications are due May 14, 2024.

2024 Excellence in Agriculture Application

2024 Excellence in Agriculture Application Rubric

2024 Excellence in Agriculture Presentation Rubric

Discussion Meet

Farm Bureau’s strength depends on its members’ abilities to analyze agricultural issues and decide on solutions that best meet their needs. The competition is designed to simulate a committee meeting where discussion and active participation are expected from each committee member. Participants build basic discussion skills, develop a keen understanding of important agricultural issues and explore how groups can pool knowledge to reach consensus and solve problems. A successful participant is a productive thinker rather than an emotional persuader. He/she will assist the group in creating ways to implement the solutions discussed and highlight Farm Bureau’s involvement in those actions/steps.

2024 Discussion Meet Application

2024 Discussion Meet Questions

7 tips for window safety

Windows provide sunlight, a nice breeze, and an opportunity to escape a home in the event of an emergency. However, without proper care and education, they can also be a huge risk to the safety of your children.

According to the National Safety Council, about eight children under the age of five die each year from falling out of a window, and more than 3,300 are injured seriously enough to go to the hospital.

As warmer weather arrives and some may wish to open windows and let the warm spring air in, it’s important to remember the dangers tied to this common home feature. This is why the National Safety Council encourages everyone to observe the first full week of April as National Window Safety Week.

Here are some basic tips to keep your wee ones safe from the dangers associated with windows:

- If a window is open for ventilation, be sure that it is not within a child’s reach. If a home features double-hung windows, open the top and keep the bottom closed, especially on upper floors.

- If a window is closed, check to make sure it is also locked.

- Keep furniture away from windows to prevent children from climbing on the furniture and potentially falling into or through the window.

- Keep in mind that screens are meant to keep insects out of homes. They are not designed to keep children from falling out of windows, and they will not hold a child’s weight in the case of a fall.

- Install limited-opening hardware, which only allows windows to open a few inches. Be aware that the window guard must have a release mechanism so that it can be opened for escape in a fire emergency.

- Always check that cords are out of reach of young children, and use cordless window coverings when possible (child-safe window blinds and shades are available at many home improvement stores). Nearly one child a month dies after becoming entangled in a window-covering cord, according to the U.S. Consumer Product Safety Commission.

- Most importantly, educate your child on the dangers of windows. For a printable children’s activity book provided by the National Safety Council, click here.

>> At Kentucky Farm Bureau, we’re just as invested in your home as you are. We help protect what’s important to you – from farms and fishing boats to minivans and mobile homes. To see a full list of products we insure, click here.

Fayette County Farm Bureau Assists Dozens of Agencies in Food Distribution Initiative

Kentucky Farm Bureau (KFB) has a long history of participating in events and programs to help feed those in need. Last month members of the Fayette County Farm Bureau (FCFB), state KFB leaders, and members and leaders within The Church of Jesus Christ of Latter-Day Saints came together to distribute 40,000 lbs. of donated food to participating nonprofits and agencies from Central Kentucky that assist with hunger relief.

This project actually got its start last summer when KFB Board members, who were on an education tour, visited Salt Lake City and helped pack boxes of food for a program overseen by the Church with donations facilitated by the Utah Farm Bureau Miracle of Ag Foundation, the American Farm Bureau Federation, and farm families across the nation.

During the 2024 American Farm Bureau Federation’s annual convention, attendees had the opportunity to pack an untold number of food boxes each containing enough food for a family of four to enjoy over the course of a weekend.

After that event, arrangements were made to have one of the many truckloads of food that the Church sends out annually, to come to Kentucky.

Fayette County Farm Bureau President Jason Whitis said there is a great need for food in the area and this project helped to fulfill some of that need.

“Surprisingly, we have a lot of children in need here in Fayette County, and we felt like if we could help them out, that'd be a great opportunity,” he said. “Working with Kentucky Farm Bureau and local church members, we were able to get 40 or 50 organizations here involved to come and help distribute this food.”

Chair Bonnie Eads prepares to deliver

food boxes for those in need.

Whitis added that there is no better group to help feed the needy than the farmers who grow the food.

“As farmers, we love to see that the efforts we're putting in to grow the food, go to help those who are needing it and are hungry,” he said. “Unfortunately, this will only last a few days and these agencies will have to look for their next opportunity. So, we're trying to develop that relationship asking how we can continue to make those connections so that these people can not only get food today, but to continue to get food when they need it.”

Troy Rindlisbacher is a farm manager, and production project manager from Utah who is one of the many farmers who grows some of the food used for the distribution boxes. He said there are many who help to support these efforts of feeding hungry people.

“It begins with a lot of us, that's for sure and the Church has these operations all over the place,” he said “It’s interesting if you look at the box, it’s full of different varieties of things grown in different parts of the country. I like to say (this initiative) is literally from seed to stomach.”

Rindlisbacher added that while the food may come from different places with different people involved, it all has a shared objective.

“We may be of different religions, we may be from different backgrounds, we grow different things, but we all have a common goal,” he said. “We try to feed people.”

Events

Young Farmer Leadership Conference

This event is designed to provide our young farmers with leadership workshops and opportunities they can use daily on and off their farms. Young Farmers are provided with resources to help grow their operations and leadership skills.

The 2024 Young Farmer Leadership Conference took place January 5-6 in Covington, KY.

Young Farmer Summer Outing

This event is designed to connect our young farmers and allow them the opportunity to travel the state and tour diverse agriculture operations; allowing our young farmers to ask questions to producers. In addition, attendees are provided a fun relaxing atmosphere to network and grow as leaders.

The 2024 Young Farmer Summer Outing will take place June 28-29 in Ashland, KY.

To attend the 2024 Young Farmer Summer Outing, Register here

Spring motorcycle maintenance checklist

Riders, rejoice! It’s nearly time to haul your warm-weather wheels out of hibernation. We know you’ve been dreaming of longer, warmer days for cruising Kentucky, but there are a few things you can do now to get a jump start on your spring riding time.

- Fill it up.

The National Automotive Parts Association (NAPA) recommends starting the riding season with a fresh tank of gas. While this may require you to rid of old gas using a siphon pump, it’s important because stale fuel can cause extensive damage to internal lines. If you winterized your tank in the fall using a gas stabilizer, then you may not need to do this step.

- Charge or replace the battery.

Many people place their battery on a trickle charger over the winter. If you forgot, be sure to test its power come springtime! Sitting in storage over winter can quickly drain your battery level, and it will likely need to be charged, if not replaced.

- Check the tire pressure.

Tires have a tendency to lose pressure during bouts of cold weather. In fact, colder temperatures will cause tire pressure to lose about 1 PSI for every 10°F drop in air temperature, according to Consumer Reports. Because of this, you should always check your tire pressure before hitting the pavement. Check your owner’s manual to find the manufacturer’s recommended PSI for your make and model. Also, do a quick inspection for any bald spots or even dry rot caused by extended periods of sitting in cold weather. Proper tire tread is essential to safely handling the road on two wheels.

- Change the oil.

Even if you had your bike serviced toward the end of last year’s riding season, NAPA says it’s not a bad idea to start the spring out with fresh oil and a filter change. Fifteen minutes can make a world of difference in your bike’s life span.

- Perform a general check-up.

Once you’ve completed the above steps, take a moment to make sure the rest of your bike is in good working condition. Do the blinkers, flashers, headlights, tail lights, and brake lights work? Do the brake pads show excessive wear? Are there any visible problems with the bike’s belts or chains? Are your brake fluid levels where they should be?

We know you’re itching to get back on two wheels, but completing this spring motorcycle checklist ahead of time can keep you and your bike safe for the entirety of the riding season.

>> Have you heard the rumblings? KFB now insures motorcycles! For more information, click here.

Combating distracted driving... with your phone?

.jpg)

If you’re a cellphone owner, you know the intense gravitational pull felt in response to a ding or vibration indicating the arrival of a new message. For most people, that magnetism unfortunately doesn’t go away when driving.

Technology got us in this mess, and technology is going to get us out. At least, that’s the sentiment of Deborah Hersman, the president of the NSC.

Cellphone companies and application developers are taking steps to combat the prevalent issue of distracted driving. Cellphone blocking technology removes the temptation of distracted driving altogether by prohibiting calls or texts while a vehicle is in motion. This technology can come in the form of a downloadable app, adding a service to your wireless plan or installing a device into your vehicle to create a “geofence” (a virtual barrier). Devices that connect with onboard diagnostics stop your phone when the car is engaged and can send an auto reply to calls and texts.

Popular tech giant Apple took their first stab at distracted driving with an iOS update in fall of 2017. The optional “Do Not Disturb While Driving” safety feature aims to keep drivers focused on the road by blocking notifications on an iPhone’s lock screen and sending a voluntary, automatic reply to those attempting to text.

This technology hasn’t seemed to catch on just yet. Only 20.5% of survey respondents with do-not-disturb-compatible iPhones had it set to activate automatically when driving or when connected to a vehicle's Bluetooth, according to a 2020 survey by IIHS.

Several third-party apps with varying features are available for download in your phone’s app store. While most of them have call- and text-blocking capabilities, others go a step further by allowing parents to track their teen drivers, blocking email and internet access, and disabling smartphone cameras.

It’s important to note that a major concern among those looking to install this technology is the ability to reach 911. Emergency overrides come standard on all blocking devices and apps.

>> In Kentucky, there’s so much to live for. Join us in driving distraction-free.

To learn more about distracted driving’s prevalence in the Bluegrass State, click here.

Distracted driving has been around longer than you think

The notion of distracted driving goes as far back as the invention of the automobile itself. There have always been external distractions – like billboards or people on the side of the road. Internal distractions are nothing new, either – tuning a radio, fiddling with the A.C., reaching for a French fry, or parenting from the front seat.

The pioneer of distracted driving

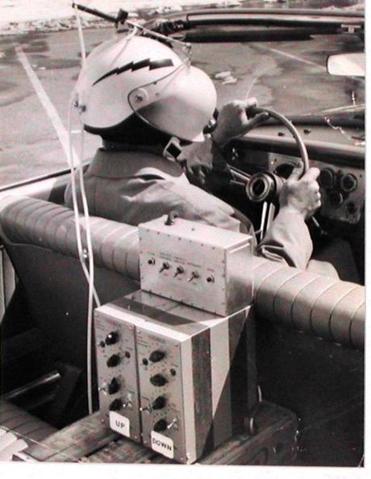

Early examples of distracted driving studies go back as far as 1963, when scientist John Senders took to the roads blindfolded – all in the name of research. The Bureau of Public Roads (now the Federal Highway Administration) tasked him with investigating how much time a driver had to spend looking at the roads to drive effectively. To gather his needed data, Senders hopped into a Dodge Polara and drove into midday traffic on I-495 in Massachusetts.

The twist: he was wearing a motorcycle helmet with a sandblasted opaque shield, which was rigged to a sensor that periodically flipped it down over his eyes. With the visor down, Senders could see nothing until he triggered it to lift again for a fraction of a second.

Senders’ findings were indicative of the future. He wrote in a report published in 1967 about the phenomenon of “road hypnotization” – staring at the road ahead, but not actually seeing it. Senders noted a plethora of distractions tugging at drivers’ focus, including the rearview mirror, conversing with a passenger, and checking out landmarks.

This study led him to develop the “occluded vision paradigm as a measure of attentional demand” (now a part of the protocol for assessment of distraction). This technique is still used today in driving studies and has a long and diverse history of applications, including its use in the development of instrument panel designs in airplane cockpits.

Senders won an Ig Nobel Prize in Public Safety in 2011 for his study, “The Attentional Demand of Automobile Driving.” He died in 2019 at the age of 99.

The arrival of cellphones

If only Senders had known what was coming next.

In 1983, something arrived on the scene that drastically changed the definition of “distracted driving.” That year, cellular telephones were introduced to the American marketplace.

By 1997, the Cellular Telecommunications Industry Association (CTIA) reported that there were more than 50 million cellular customers in the U.S. That same year, the National Highway Traffic Safety Administration (NHTSA) launched one of the first intensive studies into the effects of wireless phones on driving.

Among those surveyed, nine out of 10 cellular telephone owners reported using them while driving. This study also surveyed the effects of driving and using a cellphone (inability to maintain speed, lane drifting, and weaving). The study highlighted comments by police officers, who were seeing an increased amount of odd behavior on the roads in conjunction with cellphone usage.

According to AT&T, today more than 90 percent of people say they know the dangers of texting and driving, yet many still find ways to rationalize their behavior.

Law enforcement takes action

Florida became the first state to ban the use of any sort of mobile communications device with a law against using headsets, headphones, or any other listening device in 1992. Arizona followed shortly after in 1996, with restrictions on the use of hand-held and/or hands-free communication devices by school drivers.

In 2001, several other states (New Jersey, Illinois, Massachusetts, and New York) followed suit, enacting various bans on communications devices while driving. New York was the very first state to restrict the use of hand-held devices by all drivers.

Kentucky’s first law regarding distracted driving and cellphone usage was passed in 2007. It restricted the use of hand-held or hands-free devices by school bus drivers. On April 15, 2010, the Commonwealth House Bill 415 was signed into law, banning texting for drivers of all ages while a vehicle is in motion.

Today

In 2011, the number of wireless subscriber connections in the U.S. (315.9 million) surpassed the population (315.5 million), according to CTIA. Today, more than 97% of Americans own a mobile phone.

Currently, talking on a hand-held cellphone while driving is banned in 27 states, D.C., Puerto Rico, Guam, and the U.S. Virgin Islands. Thirty-six states and D.C. ban all cellphone use by novice or teen drivers, and 25 states and D.C. prohibit any cellphone use by school bus drivers.

Text messaging is banned for all drivers in 49 states (including Kentucky) and in D.C., Guam, and the Virgin Islands.

Click here to check out your state's laws regarding cellphone usage

In Kentucky, there is a texting ban. No laws currently restrict talking on a hand-held phone behind the wheel. Drivers younger than 18 and school bus drivers are under an “all cell phone ban,” which means these two groups are prohibited from any cell phone usage, including making hand-held phone calls.

The enforcement of these laws is “primary” in Kentucky, meaning a police officer may pull over and ticket a driver if he or she simply observes a violation in action.

In a society of increasingly unlimited availability, it’s obvious that this problem isn’t going away anytime soon. Don’t let a smiley face emoji be the reason you get a ticket – or worse. Please drive distraction-free.

>> In Kentucky, there’s so much to live for. Join us in driving distraction-free.

To learn more about distracted driving’s prevalence in the Bluegrass State, click here.

Automakers' response to distracted driving

Today, 97 percent of Americans you pass on the road own a cellphone. And despite knowing the risk, a study done by AT&T shows that about 80 percent of those cellphone owners report using them while driving. Though still underreported, cellphone usage behind the wheel continues to be an on-the-rise issue.

The auto industry has taken notice. Some tools have already been invented to curb the effects of this rampant roadway issue, while other technologies are quickly developing from budding ideas to larger-than-life innovations.

Here’s a look at some of the technologies developed to curtail the epidemic of distracted driving:

- Automatic emergency braking (AEB)

According to the Insurance Institute for Highway Safety (IIHS), many drivers involved in rear-end crashes either do not apply their brakes at all or don’t apply them enough.

A study by IIHS reported that AEB technology reduced police-reported rear-end crashes by 50 percent. It’s essentially like having another set of eyes on the roadway. Sensors on your car (cameras, radars and lasers) scan the road ahead for obstacles. If an imminent crash is detected, the system alerts the driver and begins automatically braking to reduce the severity of or prevent the collision.

A decade ago, AEB was a rare, futuristic feature only found in high-end vehicles. With distracted driving on the rise, this device is well on its way to becoming standard. Many popular automakers have already made AEB a standard feature in a majority of light-duty cars and trucks, and in 2023 the National Highway Traffic Safety Administration (NHTSA) proposed a rule that, if passed, would require AEB on all new passenger cars and light trucks.

- Lane departure warning (LDW) and lane keep support (LKS)

Like AEB, LDW can pick up the slack for a distracted driver. Say you’re reaching into the passenger seat for a bite of that drive-thru cheeseburger you just picked up and temporarily take your eyes off the road... LDW alerts drivers with an audio or visual alert when they unintentionally drift out of a lane without a turn signal on.

While LDW leaves the correction up to the driver, LKS goes a step further by taking action. If sensors detect that a car is about to unintentionally move out of its lane, LKS will correct the steering and return the vehicle to its intended path.

- Eye tracking technology

If you thought automatically-braking cars were space-age, imagine a world where cars were able to monitor your eyes and tell if you weren’t paying enough attention to the road.

Well, that technology may not be too far off. While it is still being perfected, some car manufacturers are experimenting with eye-tracking technology that would detect when a driver’s gaze has shifted and send alerts to regain said driver’s attention.

In March 2019, popular automaker Volvo announced a plan to equip new vehicles with interior-facing cameras designed to monitor a driver's attentiveness by tracking their eye movement. If the cameras were to detect that a driver is distracted by looking at their smartphone or not keeping their hands on the steering wheel, it would raise an alarm. The automaker officially revealed this technology in November 2022 in the Volvo EX90.

Additionally, General Motors has recently made significant improvements to its semi-autonomous driver-assist system, Super Cruise. The system boasts head tracking software that helps make sure your eyes are on the road, and alerts you when you need to pay more attention or take back control. Super Cruise also utilizes a host of sensors, radars, and cameras to steer, accelerate, and brake automatically. The Super Cruise network currently covers over 400,000 miles, and General Motors is actively working to grow to about 750,000 miles of compatible roadways.

While self-driving cars and innovative gadgets are sure to help our growing compulsion with smartphones, they alone can’t eradicate the problem. Make Kentucky’s roads a safe place to be, and join Kentucky Farm Bureau in driving distraction-free.

>> In Kentucky, there’s so much to live for. Join us in driving distraction-free.

To learn more about distracted driving’s prevalence in the Bluegrass State, click here.